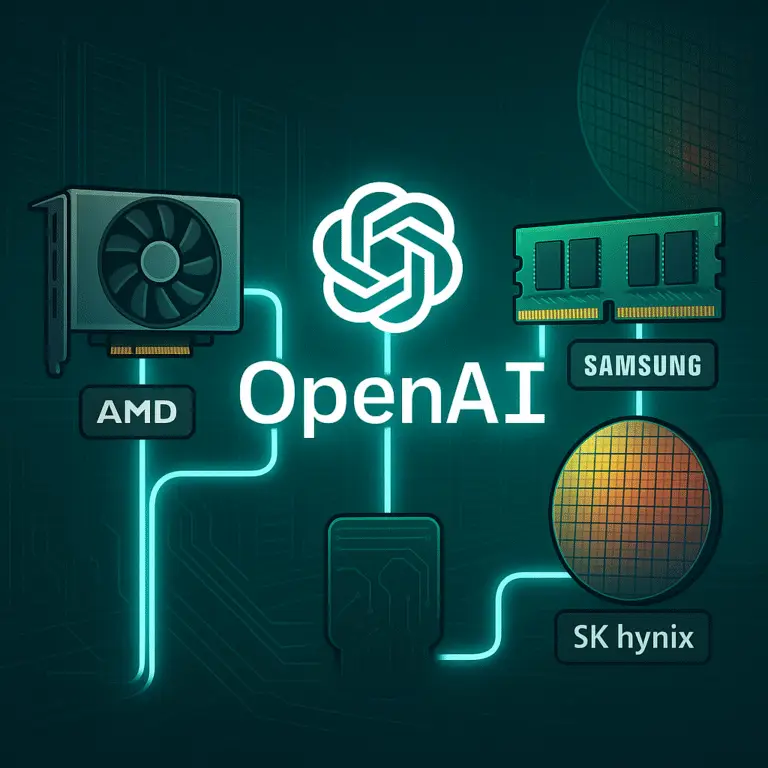

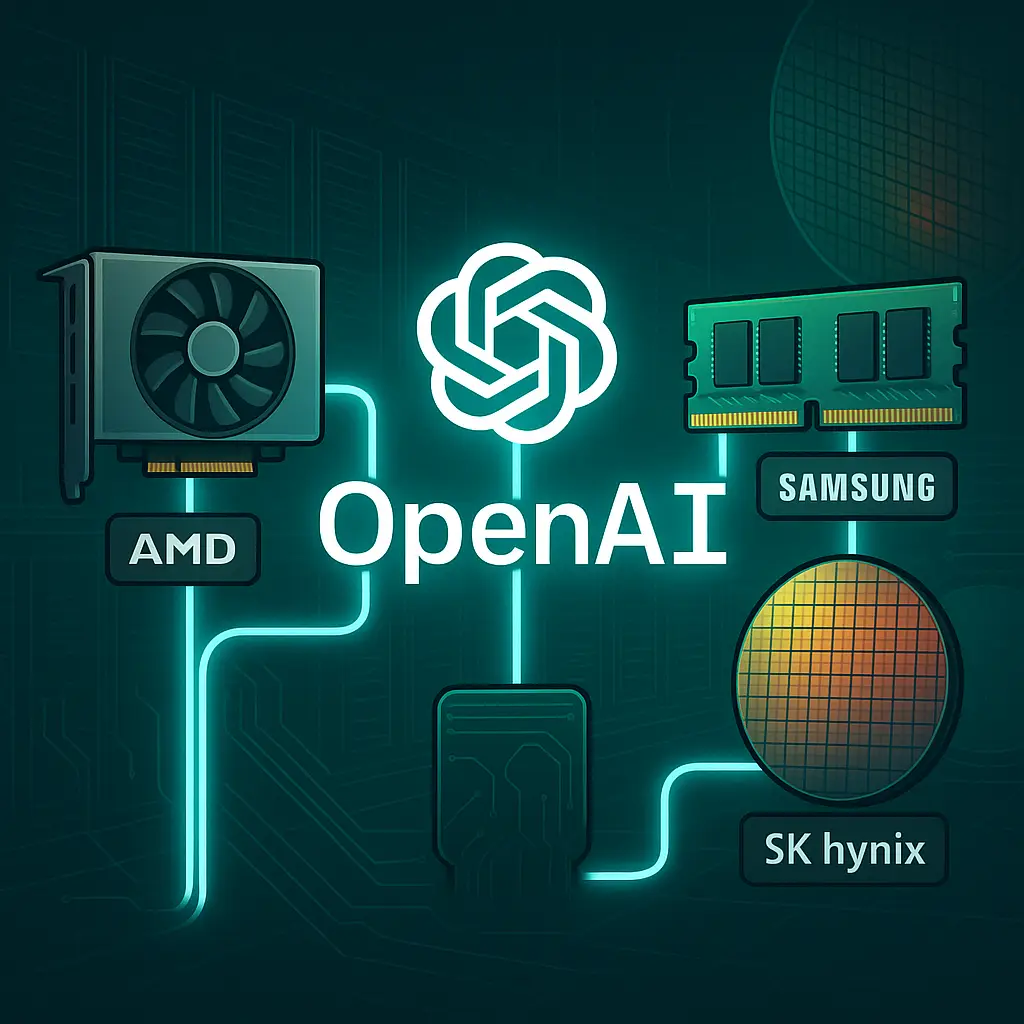

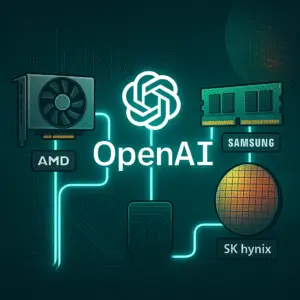

OpenAI Strikes Mega Deals with AMD, Samsung & SK Hynix

OpenAI just dramatically expanded its infrastructure arsenal, signing a multi-gigawatt chip supply agreement with AMD and soliciting memory supply letters of intent from Samsung and SK Hynix for its vast Stargate project. These deals underscore how vital hardware supply chains have become in the global AI arms race.

What Happened

AMD Agreement

OpenAI and AMD announced a definitive agreement to deploy up to 6 gigawatts of AMD’s Instinct MI450 GPUs over multiple years, beginning with 1 GW in the second half of 2026.

As part of the deal, AMD granted OpenAI warrants for up to 160 million shares (~10% of AMD) to vest on milestone-based performance.

The announcement sent AMD stock surging over 20+% intraday.

Memory Supply (Samsung & SK Hynix)

Meanwhile, OpenAI signed letters of intent with Samsung Electronics and SK Hynix to supply memory for its Stargate AI data center initiative.

The planned memory supply could reach 900,000 DRAM wafers per month, which could account for as much as 40% of global DRAM output at scale.

South Korea will host “Stargate Korea” datacenters in partnership with Samsung, SK Hynix, and government support.

Why It Matters

Hardware Supply Is a Strategic Bottleneck

As AI models grow larger, access to high-end GPUs and memory modules is more than a technical challenge — it’s a strategic chess piece. OpenAI’s dual approach (compute + memory) shores up its supply chain and reduces dependency on any single vendor.

AMD Gains in the AI Chip Wars

This deal positions AMD as a major contender to Nvidia’s dominance in AI GPUs. The warrant arrangement aligns both companies’ incentives and signals long-term confidence.

Memory Demand May Reshape DRAM Markets

If Stargate consumes up to 900,000 wafers monthly, it could absorb a disproportionate share of global DRAM supply — disrupting pricing, availability, and production priorities.

Geopolitical Moves & Sovereignty

South Korea is now deeply involved in AI infrastructure strategy. “Stargate Korea” marks an attempt to localize AI infrastructure and tap into national support and sovereignty goals.

What’s Next

AMD deployment ramps up: first 1 GW set for late 2026.

Full memory integration: Formal contracts with Samsung and SK Hynix and memory module supply (HBM, DDR, etc.).

Data center expansion: Stargate Korea launch, U.S. site expansions, and global scaling.

Supply chain risk mitigation: OpenAI will likely seek additional memory and GPU partners, or possibly develop its own AI hardware in parallel.

Market volatility: DRAM and GPU prices may fluctuate dramatically, impacting AI startups and data center costs globally.

“OpenAI’s power play isn’t just about compute—it’s about controlling every layer of AI infrastructure.”

Key Takeaways

- OpenAI signs a 6 GW GPU deployment deal with AMD (Instinct MI450).

- The deal includes warrants giving OpenAI up to ~10% stake in AMD.

- Samsung and SK Hynix will supply memory chips to Stargate, targeting 900,000 wafers/month.

- Stargate’s memory demand could rival ~40% of global DRAM supply.

- The hardware moves signal that infrastructure is now the most competitive frontier in AI.